Behavioral Economic Stress Testing at Symetrics, a FinTech50 company that keeps me on the flow of life, kept me from blogging last months. Nevertheless, here's a new blog to chew on.....

Low Interest Rates

In traditional investment models, low and even negative interest rates are seen as simple stochastic outcomes, that eventually converge to the mean of the historical data as time progresses.

The well-known answer to the question "how long will interest rates stay low?" is mostly: don't worry, interest rates will rise again!

In our long term investment models the output equals the input. If we 'believe' that the average interest rate is 5%, than on the long term that's where we we'll be at....

At least, in our model, certainly not in reality.

Unfortunately, there is no such thing as 'mean reversion'. The reason why interest rates got down, is due to monetary, regulatory and economic drivers, that will keep and push interest rates down, as long as there's no substantial debt relief in combination with real (not paper-financed!) economic growth.

In a world with extreme low and even negative interest rates, financial (long term saving) institutions have no future. Based on one year default probabilities, traditional regulatory frameworks eventually force those long term guarantee institutions (e.g. mortgage banks, life-insurers and pension funds) to derisk their balance sheets and raise the price of their products. However, consumers are prepared to make a risk-return assessment on different grounds and are no longer willing to pay the price for risk.

Example

Let's illustrate this risk-return dilemma with a simplified practical example in a (unlikely?) long low interest world.

We consider the following portfolio investment case:

- Bonds (US) with average return of 1% and a standard deviation of 4%

- Stocks (S&P 500) with an average 8% return and 16% standard deviation

Next, we take a look at the Efficient Frontiers of the asset-mix combinations of Bonds and Stocks:

To prevent endless discussions we simply compare two possible portfolio investment strategies:

- Portfolio A: 80% Bonds & 20% Stocks

- Portfolio B: 20% Bonds & 80% Stocks

Obviously Portfolio A (PF-A) with an annual expected return of 2.4% and a (non-correlated) risk of 4.6% looks less risky than PF-B. On the other hand PF-B with an expected 6.6% return and a (non-correlated) risk of around 13% looks promising on the long run. What to do? What is more or less risky?

The Risk of Risk

What is more risky, also depends on the risk premium. One traditional way to judge the pay out on risk, is to compare the 'Sharpe ratios' of the two portfolios. Major problem is to determine the appropriate 'risk free interest rate level', as the risk free rate is risky (volatile) itself and declining on average the last years.

What is more risky, also depends on the risk premium. One traditional way to judge the pay out on risk, is to compare the 'Sharpe ratios' of the two portfolios. Major problem is to determine the appropriate 'risk free interest rate level', as the risk free rate is risky (volatile) itself and declining on average the last years.

So in fact we have to judge:

The Risk of Risk

To get an impression of the risk of risk free interest rates, we calculate the Sharpe ratios of the efficient frontiers.

Here are the outcomes:

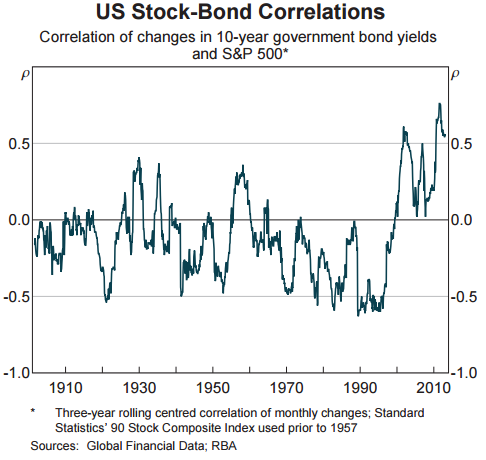

The above charts illustrate that at nearly every (0% - 3%) free risk interest rate, Sharpe ratios of PF-A are lower or somewhat equal to those of PF-B. Only in the case that Bonds are clearly negatively correlated with Stocks at a 0% or 1% risk free interest level, a PF-A strategy is less risky than PF-B.

As in 'normal' crisis situations most asset-classes (excluding Gold of course...) tend to be extremely positively correlated, PF-B is - also in this case - the preferred strategy. In other situations, the Bonds-Stocks correlation only changes incrementally, so your portfolio asset-mix can be adapted timely. There's no need for anticipation.

Another remark is that in case of an 0% risk free interest rate and an expected neutral to positive correlation between Bonds and Stocks, the Sharpe ratio values all converge between 0.4 and 0.5.

This implies that a clear criterion for taking an underpinned investment decision is absent. Investors become indecisive and that's just the situation we're in mid 2015, where all we seem to have are

Investment Beliefs

Wrap up:

On top of, it's interesting to analyse how PF-B makes its return as opposite to PF-B.

Without further comments, I'll give some illustrations. Make your own analysis with help of the Excel spreadsheet.

As expected the PF-B performs better in the [9%,∞] segment. PF-A gets its returns in the [0%,9%] segment and quite surprisingly PF-B performs better in the [-5.25,0%] segment.....

All this reasoning leads to a kind of 'informed decision' conclusion that in the current economic situation PF-B would be the best (preferred) strategy. However, there's another question to be answered....

Key question with regard to PF-B:

Can you absorb the extra yearly volatility?

In 'normal'' regulatory frameworks, like Basel-III, Solvency-II and the upcoming 'Holistic Balance Sheet' for pension funds, the answer will mostly be:

NO

One of the big issues in all of these frameworks is that risk and solvency margins are defined on basis of a one year default probability. This leaves no room to absorb one year standard asset deviations of around 12%. A commonly used solution is to 'hedge' these risks 'away'. However, hedging has its price and introduces new (collateral, clearing, systemic) risks. Hedging 'one deep' could perhaps be a solution, but as the market changes, soon you'll be

Hedged to Hedging...

A better approach than hedging or the alternative of deleveraging balance sheets, would be to adapt and redesign our regulatory frameworks to the long term scope of financial institutions. This could be done by stretching the 'one year default criterion' to an 'n-year default criterion', where "n" is in line with a financial institution's ability to timely readjust company's liabilities and assets.

For a mortgage bank, a life insurer, "n" could in the order of 5 years. In case of a pension fund, "n" could vary between 5 and 10 years.

In this approach, the current different 'one year default probabilities'

| Financial Institution | Default Probability |

| Banks | 99.90% |

| Insurers | 99.50% |

| Pension Funds (Dutch) | 97.50% |

could be replaced by one uniform default probabilities of (say) 99.9% for n-years.

Here's the wrap up outcome for a 5 year average:

Notice that the expected average 5-year risk (standard deviation) has declined from 12.8% to 5.7% (= 12.8/ (√ 5)). This would roughly (rule of thumb) reduce capital requirements to a level of 19% (=5.7*3.27) of the balance sheet net-total, which is of course still substantial.

Conclusions

Low interest rates force financial institutions and regulators to rethink and redesign their business model.

Regulatory default rates have to be uniformed and the regulatory (EIOPA) system of 'one year default rates' has to be extended to a 'n-year default approach', where "n" is in line with a financial institution's ability to timely readjust company's liabilities, assets and capital.

Regulatory default rates have to be uniformed and the regulatory (EIOPA) system of 'one year default rates' has to be extended to a 'n-year default approach', where "n" is in line with a financial institution's ability to timely readjust company's liabilities, assets and capital.

After all these technical adjustments, also our investment models and methods have to be redesigned. Models, like demonstrated in this blog, that only rely on past observations are too limited for sound investment analysis.

Traditional investment models cannot cope with current market conditions and lead to indecisiveness or the next best alternative : 'Investment Beliefs'.

We have to develop models where we can risk risk...

How can we build more expressive models? Well, that's something for my next blog.....

Traditional investment models cannot cope with current market conditions and lead to indecisiveness or the next best alternative : 'Investment Beliefs'.

We have to develop models where we can risk risk...

How can we build more expressive models? Well, that's something for my next blog.....